The Interview I Art Collector VonMises

As the year comes to a close, we are excited to share our final interview of the year with a true pioneer in the digital art space, VonMises. A long-time admirer, Kate Vass first encountered his insights during the early days of ArtBlocks.

We are thrilled to share this conversation with VonMises, a prominent collector known for his deep appreciation of digital art. VonMises stands as a testament to the pioneering spirit of collectors who saw the potential of blockchain technology long before it became mainstream. Through our dialogue, we dive into his journey, the inspirations behind his collection, and his insights on the future of digital art.

We hope you enjoy this interview as much as we did.

KV: Could you describe the moment or event that catalyzed your transition from traditional finance to the cryptocurrency world? What initially drew you to Bitcoin as an early adopter?

VM: It was in April of 2011, I was reading up on one of the financial market blogs and saw a story that caught my attention. It was an article on a new currency called Bitcoin. As a financial markets nerd, I was immediately interested. Within a week of reading that article, I had purchased my first bitcoins, from the now defunct Japanese based exchange MTGOX, and my world began to change in ways I could have never imagined.

I had felt for a long time that the world needed a digital cash equivalent, something that allowed a person online to transact without the need for an intermediary and in an anonymous way. While many others had tried, Bitcoin solved a lot of the problems that had caused other digital currencies to fail. While I wasn't sure at the time that BTC was a game changer, I knew having some exposure to it made sense.

Dmitri Cherniak, The Eternal Pump #3, 2021

KV: You acquired 60 CryptoPunks within the first month of discovering them. What convinced you that they were worth such a significant early investment?

VM: I've always been into collecting during my life from coins, to sports cards to watches and a few others, but when I came to NFTs and specifically CryptoPunks I knew I was looking at something special. In a lot of ways, it almost felt like my whole life had prepared me for this moment as CryptoPunks combined trading, collecting and crypto all into one! I remember telling my wife that I thought Punks were the best collectible I'd ever seen and that they would easily go up 10x in short order. Here's one of my first discord posts from April of 2020. In April of 2020 you could buy a punk for $150-200.

@VonMises14’s post on X from 30.04.2020

KV: You use CryptoPunk#1111 as your digital representation. Could you share what this piece personally means to you?

VM: While I have owned many rarer and more valuable punks, when I bought punk #1111 for 1.111 eth in September 2020, he just really resonated with me. For me repping a punk was never about making a digital flex, it was always about sharing in a community and showing respect to all the builders and true pioneers in the space who also rep a punk. I also felt like punk #1111 looked like me, as much as a punk can look like someone I suppose, although I don't ever wear a silver chain! Now that I have a following and I'm known in the NFT space, it's me and the face of VonMises. I can't imagine ever using something else and I hope to pass him and the VonMises "brand" on to my daughter someday.

Larva Labs, CryptoPunk #1111, 2017

KV: You chose the name Von Mises, inspired by Austrian economist Ludwig von Mises. Can you explain why his views or he himself is important to you?

VM: Most people who study economics are taught "Keynesian" economics, a school of thought based on the ideas of John Maynard Keynes. This approach is widely accepted and taught around the world, and it’s what I was taught when I studied economics. However, I always felt there were gaps in Keynes' explanations of the business cycle and the role of government in the economy. After learning more about Austrian economics, especially the ideas of Ludwig von Mises, many of these gaps started to make sense.

The Austrian School emphasizes the importance of free markets, the distortions caused by central banks, and the real causes of economic recessions. It challenges the Keynesian view that government intervention is the key to economic stability. In fact, Austrian economists believe that such interventions often worsen economic problems by distorting market signals and misallocating resources.

I believe Ludwig von Mises would have strongly supported cryptocurrencies like Bitcoin if he were alive today. Bitcoin is a form of money that is valued by the market, not determined by government decree, which aligns with Mises’ view on the importance of market-driven money and the dangers of central bank control.

DEAFBEEF, Series 0: Synth Poems - Token 124, 2021

KV: How do you balance personal interest with market trends when collecting NFTs? Do you always follow investment principles, or do you sometimes buy purely for enjoyment?

VM: I tend to be a completionist in my collection style, so if I decide I like something I will want to have all or as much of it as possible. While I try to stick to a relative value framework I do also buy NFTs for personal reasons and enjoyment value.

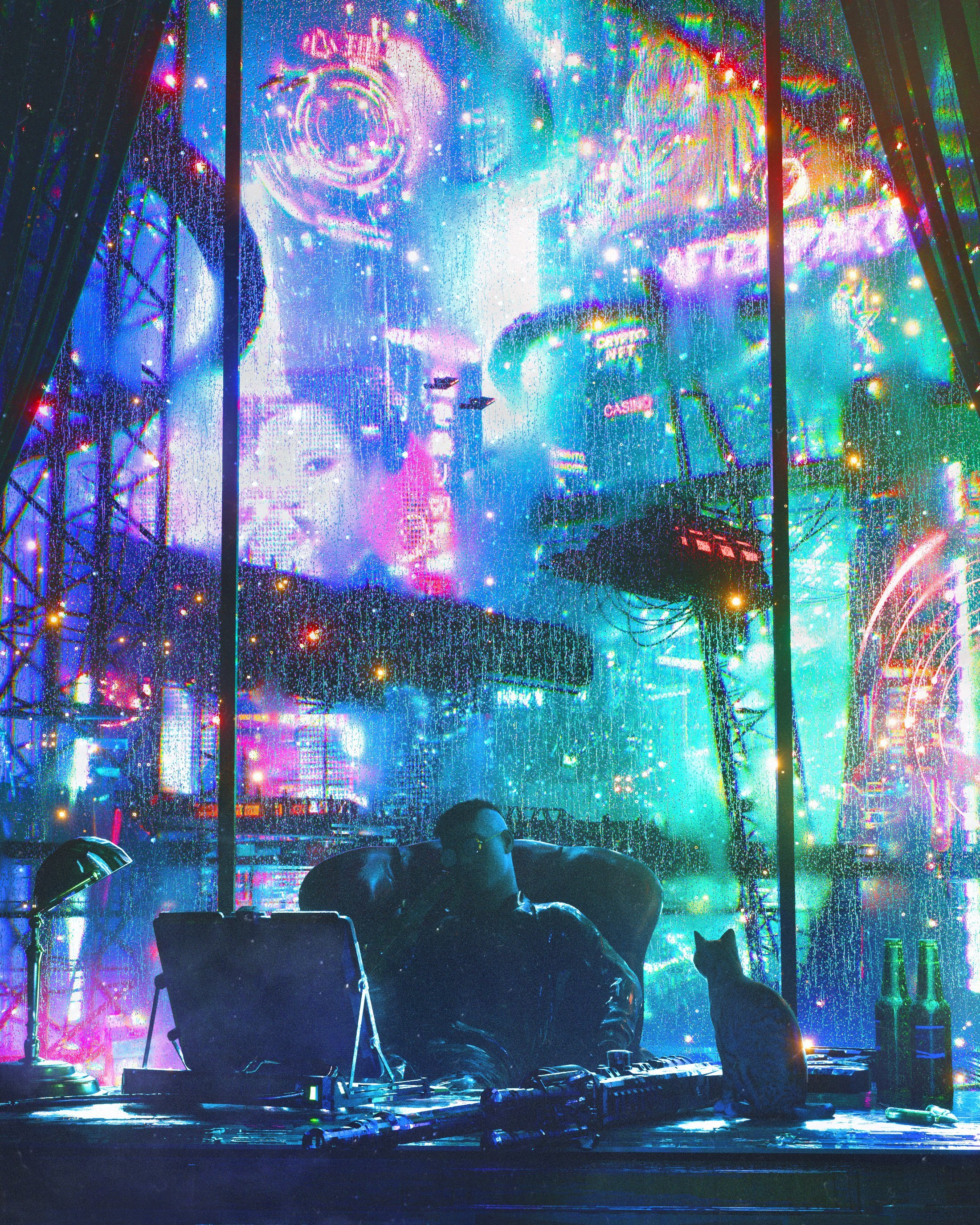

Dangiuz, Flyswatter, 2022

KV: Your collection spans CryptoPunks, XCOPY, Beeple, Bored Ape Yacht Club, Tyler Hobbs, and DEAFBEEF. How do you manage such a varied portfolio, and are there specific styles or genres you’re particularly drawn to?

VM: I'm really trying to assemble a collection of early, historically significant and culturally relevant art and collectibles from this golden era of digital assets. Many times I'm able to spot which ones will fit this before they run up in price like XCOPY, Punks and Art Blocks, but sometimes I don't see it in time and have to make a decision much later and at a much higher price. While I try not to chase assets I miss out on early, on occasion I'll pay up to have something I missed that fits my longer term criteria.

XCOPY, Last Selfie, 2019

KV: You've expressed a general intention to hold onto your collection and mentioned not wanting to sell many items. How do you decide which NFTs to sell?

VM: For me having one of something is pretty much the same as having none because once I decide to buy I typically won't sell out of it completely. Thankfully my strategy once I decide I like something is to buy more than one. This allows me to hold a position and still allow room for some sales if others enter the space and decide they want to own some as well.

DCA, Genesis #183, 2020 (VonMises’ first Art Blocks mint)

KV: What initially drew you to ArtBlocks, and how did you first connect with Snowfro?

VM: Back in early 2020, the CryptoPunks Discord was a truly special place. There were only about 30 of us actively chatting daily about NFTs, discussing how Punks would one day be recognized as real art, and how museums would eventually own them. The relationships formed during those early days are irreplaceable, as the purity of that moment is something you can't recreate today. When you have a core group of true believers, all obsessively diving into the technology and fully convinced of its future, you create a unique bond based on shared conviction—not on money.

This is where I met Snowfro. He was incredibly generous with his time and knowledge and one of the most honest people I encountered in the space. I was quite active in the Punks Discord, frequently sharing my bullish takes on Punks, and we had many discussions around our shared belief in the future of the space.

Around September or October of 2020, Snowfro began talking about his new generative art platform, Art Blocks, which he was about to launch. As someone I respected and admired, I knew I had to be involved when Art Blocks launched to show my support for Snowfro.

Tyler Hobbs, Fidenza #592, 2021

KV: As an early member and curator of the Art Blocks curation board, what criteria did you use to select and endorse generative art pieces?

VM: In the early days of Art Blocks it was more about how the art felt relative to what I had seen in the past. With Art Blocks still in its infancy there wasn't a lot to go on. Often my criteria would be something like, would I be willing to hang this piece on my wall?

Dmitri Cherniak, Ringers #206, 2021

KV: You managed to mint 350 Chromie Squiggles. What attracted you to this project, and how do you decide which pieces to keep and which to sell?

VM: My support for Snowfro was the primary driver. When it comes to selling or trading, I would typically sell my least desirable pieces first and hold on to the better ones. On occasion I would list better pieces for sale but only if I had multiple examples and only at high prices. I firmly believe in the old trading mantra "sell when you can, not when you have to"

Snowfro, Squiggle #463, 2021

KV: You sold one of your Autoglyphs, #392, for 375 ETH, marking a significant transaction. Why did you decide to sell it at that time, and did the sale enable you to acquire other important pieces or invest in new projects within the NFT space?

VM: This sale happened in October 2021, to me the market had begun to feel like it had peaked. It wasn't clear but given how much the value of Autoglyphs had moved up, and given that I still had 2 additional Autoglyphs, it just made sense to let that one go. I'm sure some of the proceeds made their way into other art pieces, but I don't remember if it went to something specific.

Larva Labs, Autoglyph #392, 2019

KV: When you used 60 BTC for a purchase on Silk Road, did you ever imagine Bitcoin would reach its current valuation? Have you made any trades in your life that you consider mistakes or missed opportunities?

VM: When I was buying BTC in the early days, I mentioned it to lots and lots of investment professionals. My sales pitch was something like "there's a 95% probability that you'll lose all or most of your money, but here's why you should still buy it". I then went on to explain how the potential was there for 1000x type returns. While seeing BTC at 100k is well beyond what anyone could have realistically envisioned back in 2011, I did know big moves up were very possible and to reach the level of a true global currency would require more than a 1 trillion dollar market cap. In my opinion there are absolutely scenarios where BTC climbs well above 1 million USD. When it comes to mistakes or missed opportunities there's not a whole lot I'd change other than buy more of what I bought!

Hideki Tsukamoto, Singularity #253, 2021

KV: In addition to CryptoPunks, Fidenza, and Autoglyphs, you own works by generative art pioneers like Herbert Franke. What draws you to early generative art, and how do you view its importance in the NFT space?

VM: I feel it's important to pay respect to the pioneers of generative art for sure. I had the pleasure of meeting Manfred Mohr in NYC after purchasing one of his early works. It was very cool to see his studio and he showed me a lot of his early works and shared his journey as a true pioneer. He has the first computer hard drive disk he used mounted on his wall. It's about one meter in diameter and he told me it had a memory of like 5 kilobits! Owning an early Herbert Franke is something on my list, perhaps you can help me out here!

Herbert W. Franke, Math Art (1980-1995) - Math Art 95 - No. 3, 2022

KV: Having lived through multiple bear markets in both traditional and crypto finance, what strategies have helped you navigate these challenging periods?

VM: I try to always remember that It's never as good at the top as it feels and it's never as bad at the bottom as it feels. Markets always over react in both directions so try not to be too focused on the short term. I never let short term sentiment skew my longer term view. During the recent NFT bear market it's natural for people to just straight line extrapolate out the downtrend and assume we are headed to zero. For this to be true, You would need to accept that NFTs have no future, which to me is just insane to say. The benefits that blockchain technology brings to art and collectibles is nothing short of revolutionary and with near 100% certainty NFTs have a very bright future.

I try to always have a well thought out thesis that I can refer back to in times of distress. If you know what you own and understand why you own it, the short term means a lot less and you can stay in a position without being shook out by bad short term volatility or uncertainty.

Bryan Brinkman, NimBuds #187, 2021

***

*The responses provided in this interview have been preserved in their original form, with no alterations to the interviewee's stylistic choices or grammar. - Kate Vass

VonMises on X: @VonMises14

Collection link: https://deca.art/VonMises?filters=1&details=1&sort=ACQUIRED_DESC